Partager :

In today’s interconnected Europe, a surge of ecological consciousness and economic realities are fueling transformative changes within the finance mobility sector. As customers are reframing their behaviors with sustainability in mind, the mobility industry is accelerating its metamorphosis to integrate the opportunities presented by the digital era. This paradigm shift is leading to great innovative practices and models within the mobility sector.

Indeed, in this dynamic landscape, industry giants are not just spectators. Their proactive adaptations, reflected in events like the major Stellantis merger (PSA, Opel Vauxhall Finance and Fiat) and the renaming of RCI Bank & Services to Mobilize, signify a commitment to navigate these transformative waves. These changes, far from being mere reactions, are strategic moves designed to provide value in a fiercely competitive market, while meeting the ever-evolving customer expectations. As pillar to the largest financial services in the mobility sector, QuickSign delves in this article on what is at stake in this sector today.

Embracing Hybrid Onboarding

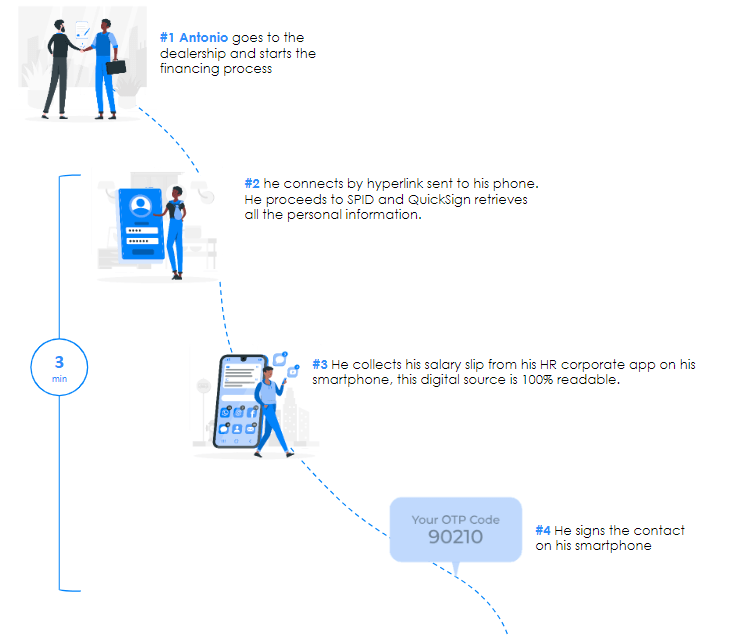

First of all, unlike online banking, financing a car necessitates—at some point in the onboarding journey—a physical interaction. That interaction can happen as early as testing the car in a showroom or as late as the delivery of the vehicle itself. The physicality of the experience however, need not happen at a specific moment in time, nor to all members. That’s where the hybrid onboarding model kicks in. By combining the efficiency of digital onboarding with the personal touch of traditional methods, businesses can offer a streamlined, hassle-free onboarding experience.

Typically, around 50% of car financing is co-financed between at least two people (often a couple, but a guarantor can also be involved). Moreover, in this case, one person can be in the dealership or showroom while the partner chooses to proceed to their onboarding in the comfort of their home or on-the-go.

The hybrid model reduces agenda constraints, provides a more engaging customer experience and speeds up the onboarding journey. This ultra-adaptation to each customer’s preferences implies significant tech agility and orchestration. As the powerhouse behind the scenes, Quicksign provides 100% compliant services (more information on our services here.)

Mobility Sharing and Leasing Models

Secondly, the rise of mobility sharing and leasing models reflects a broader societal shift towards flexible and sustainable modes of transportation. With the increasing demand for greener alternatives, companies in the finance mobility sector are adapting their offerings to include more sustainable options.

Besides, in response to these trends, more businesses are implementing flexible leasing and sharing models, moving away from traditional vehicle ownership. Though leasing was historically a B2B sector, its largest growth is in the B2C sector with leading actors such as Tesla paving the way.

Leasing models provide customers with greater flexibility, lower upfront costs, and access to a range of vehicles that suit their needs. Furthermore, it also impacts onboarding as the speed at which customers change their vehicles–and therefore proceed to a new onboarding–is on the rise. With its highly industrial, cross-nation onboarding, QuickSign is here every step of the way.

Bonus: Leasing 2.0 integrating ARR Models into Car Selling

A fascinating development is the integration of ARR models into car selling. In an ARR model–Annual Recurring Revenue–has thusfar been a digital-only finance models. With the rise of intelligent vehicles powered by AI, ARR has entered the mobility sector. Customers who have purchased or are leasing a vehicle can subscribe instead of making a one-time purchase.

Take for instance, BMW’s monthly subscription model for £15 / month that triggers heated front seats. This subscription-based service not only benefits consumers with flexibility and an enhanced ownership experience, it also provides manufacturers with a consistent revenue stream for better financial planning. Depending on the evolutions of ARR models, and the services they provide, financial mobility actors will need compliant digital onboarding. QuickSign is already preparing to ensure seamless–and coherent throughout the lifecycle–onboarding journeys.

The Road Ahead

In conclusion, the finance mobility sector continues to evolve rapidly, with innovative practices like hybrid onboarding, leasing and mobility sharing models, and the integration of ARR models. Amid these exciting changes, businesses must continue to innovate and adapt to meet the changing demands and expectations of their customers.

QuickSign, known for its innovative digital onboarding solutions, has effectively leveraged advanced technologies in KYC, smart data management and compliant electronic signatures, to facilitate the rapid changes within the mobility sector. QuickSign’s expertise in secure digital signature and identity verification is particularly beneficial for businesses in the leasing and mobility sharing domains, enhancing customer experiences through streamlined onboarding and reducing operational costs. We are proud to participate in the digital transformation of the leading mobility actors across Europe.

Written by Charlotte S.

More posts on this topic