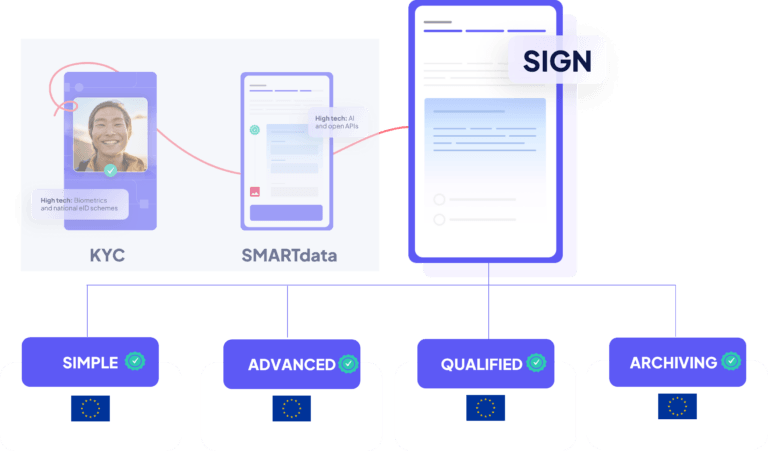

eIDAS compliant electronic signatures for financial services: including consent management and archiving. Optimize your customer journeys, stress-free.

Electronic Signatures are fundamental for financial services. They seal the bilateral trust between a customer and the financial entity. At times, they can include additional members: co-borrowers, guarantors, agents, dealerships… The role of the electronic signature is to seal the contractual relationship for the longterm (typically 10-20 years).

QuickSign was the first in Europe to provide on-the-fly certificates, enabling anyone to sign online (no equipment needed). Since this pioneer step, we have been increasingly optimizing the contractual process: including high-end consent management, audit trails and personalized proof files that are easy to read by a judge in case of ligitation.

All our signatures are eIDAS compliant.

It’s quite simple: if you are a financial service in need of an electronic signature, we have got you covered. From insurance to balloon contracts, to credit and account openings – we’ll take you through the steps, easily.

All eIDAS levels are included in our SIGN services… and more: consent, event tracking, audit trails. The complete suite for financial service serenity over time.

The eIDAS regulation was established by the European Union in 2016 to provide a standardized framework for secure electronic transactions.

eIDAS ensures cross-border recognition of electronic identification and trust services within the EU. Within this framework, QuickSign’s eIDAS-certified KYC facilitates secure and compliant identification processes recognized by all Member States. QuickSign has been certified since 2022.

LSTI (Laboratoire de Sécurité des Technologies de l’Information) is a French certification body that assesses the security of information systems.

A trusted provider like QuickSign seeks LSTI certification to demonstrate its commitment to high security standards and earn the trust of its partners. We have been strengthening our reputation since 2015 with LSTI.

ISO 27001 is an international standard for information security management systems.

Trusted suppliers seek ISO 27001 certification. QuickSign has been demonstrating its commitment to protecting information assets since 2014.

eIDAS, or electronic Identification, Authentication and Trust Services, is a European Union regulation that standardizes electronic transactions across EU member states. The regulation outlines the criteria for electronic identification and provides a legal framework for digital signatures, timestamps, and related trust services, such as KYC. eIDAS serves to facilitate cross-border electronic transactions, promote trust, and ensure the security of online services. It is recognized by all Member States.

As a financial service, it can be difficult to navigate the different levels of electronic signatures, understanding the implications and impacts. The below information is a high level explanation. For specific advice on your use-case, please contact us. Our teams will gladly assist.

The Simple Electronic Signature (SES)

The SES is comparable to consent gathering. It is data in an electronic form which is attached to or logically associated with other data from an electronic form. This data, often in the form a tick box, is used by the signatory to sign. In continental Europe, this signature level is rarely used for financial products (exceptions can be found in Poland).

The QuickSign SES complies with the eIDAS regulation through:

The Advanced Electronic Signature (AES)

The AES is an SES + it is uniquely linked to the signatory. It is therefore capable of identifying the signatory. It is created using electronic signature creation data that the signatory can, with a high level of confidence, use under his sole control; and it is linked to the data signed in such a way that any subsequent change in the data is detectable.

The AES is a common level of signature in continental Europe for account openings and small ticket consumer credit.

The QuickSign AES compliques with the eIDAS regulation through:

The Qualified Electronic Signature (QES)

The QES is the AES + a qualified certificate. It’s strength is that is reverses the burden of proof. In case of litigation, a customer must prove that they did not sign. The QES is often used for consumer credit in – but not limited to – Italy, Germany and Belgium.

The QuickSign QES complies with the eIDAS regulations through:

Check out our ressources

Contact support

demo@quicksign.com

(+33) 01 82 52 05 00