Provide compliant KYC across Europe with QuickSign’s certified services, the most comprehensive, compliant and optimized KYC suite on the market for financial services.

KYC – Know Your Customer – is dedicated to proving the identity of future customers. It’s a fundamental and highly regulated process for financial services, which involves verifying a person’s identity no matter context: in-store, online, hybrid… whilst complying with European AML /CFT standards.

Our vision: democratize KYC by providing simple, deeply intuitive and 100% compliant solutions.

The purpose of KYC is to prevent money laundering, fraud and other illicit activities that could threaten the integrity of the financial system.

KYC involves the collection of customer information, including name, address, date of birth and national identification number, as well as other relevant information. Financial service providers must verify the authenticity of this information using reliable and independent sources, such as government-issued identity documents, biometrics or national eID schemes.

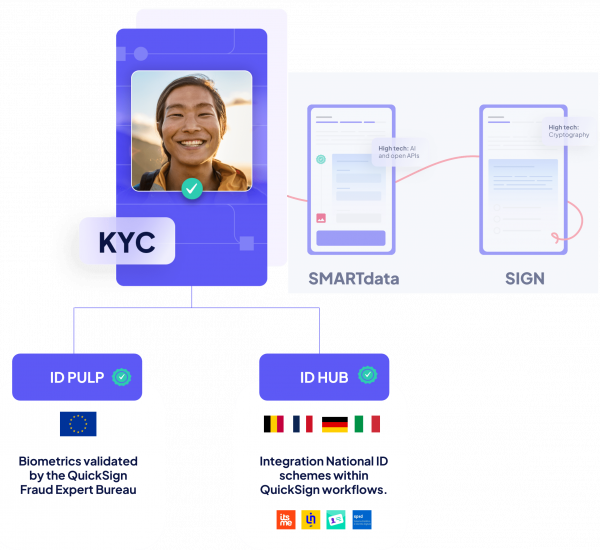

QuickSign’s KYC strength lies in:

1. The most comprehensive and market-specific KYC services on the market.

2. The ability to trigger appropriate KYC services based on the prospects’ preferences and/or exceptions. We manage the complexity of KYC services to ensure simplicity in the front end.

This dual combination repeatedly ensures that QuickSign provides the highest performance rates on the market.

Build your customized workflow for maximum performance.

The eIDAS regulation was established by the European Union in 2016 to provide a standardized framework for secure electronic transactions.

eIDAS ensures cross-border recognition of electronic identification and trust services within the EU. Within this framework, QuickSign’s eIDAS-certified KYC facilitates secure and compliant identification processes recognized by all Member States. QuickSign has been certified since 2022.

ANSSI (Agenge Nationale de la Sécurité des Systèmes de l’Information) is a French National agengy responsible for computer security on the national level.

QuickSign is currently in the last steps of the PVID certification for its French specific KYC process. For more information, please contact our teams.

LSTI (Laboratoire de Sécurité des Technologies de l’Information) is a French certification body that assesses the security of information systems.

A trusted provider like QuickSign seeks LSTI certification to demonstrate its commitment to high security standards and earn the trust of its partners. We have been strengthening our reputation since 2015 with LSTI.

ISO 27001 is an international standard for information security management systems.

Trusted suppliers seek ISO 27001 certification. QuickSign has been demonstrating its commitment to protecting information assets since 2014.

KYC mainly concerns financial institutions such as banks, credit services, insurance companies and payment platforms.

The main aim of KYC is to prevent money laundering, fraud and other illicit activities that could threaten the integrity of the financial system. KYC must comply with current laws and regulations, assessing the risks associated with each customer in order to create a secure and transparent financial environment.

By complying with KYC regulations, financial companies can reduce the risk of fraudulent customers and protect their reputation.

There are 3 methods of identification:

KYC involves collecting information about the customer – name, address, date of birth… – by verifying the authenticity of this information using reliable, independent sources, such as government-issued identity documents.

KYC documents may vary according to the specific regulations and requirements of each financial institution and country. However, commonly requested KYC documents include a valid identification document such as an ID card, passport or residence permit. Certain countries such as the UK, Austria and Italy will allow the driver’s license.

Yes, absolutely as part of our SmartData service.

In order to complete an application with a financial service in Europe, other documents are often requested. These include a recent proof of address such as a utility bill (electricity, gas or telecoms), a bank statement, as well as additional documents such as payslips and/or tax statements.

QuickSign is an expert in processing this information using AI. For more information, please visit our SmartData service.

Check out our resources

Contact support

demo@quicksign.com

(+33) 01 82 52 05 00