Collect and validate the information needed to access a financial product. The prospect shares in one click, for validation in record time.

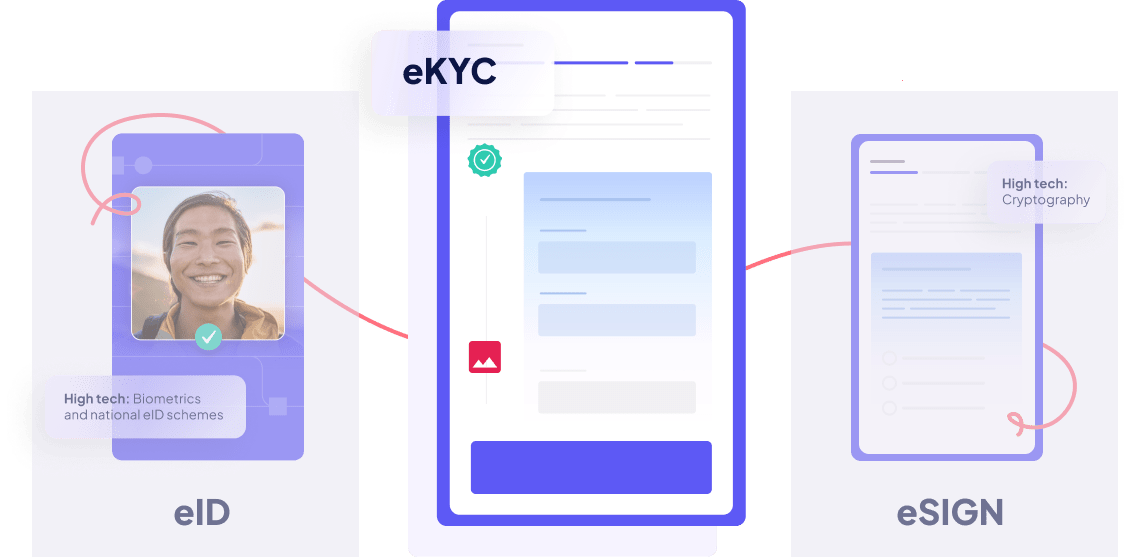

eKYC (acronyme of electronic Know Your Customer) retrieves valid customer information in order to grant access to a financial product. These data can be collected via the user (document upload, IBAN, salary) or via trusted third parties (connection via FranceConnect or Spid for example). It varies based on the financial product, the financial service and the country.

QuickSign’s position is to ensure that no matter the context, any customer can easily provide the necessary information. For documents, that means triggering advanced technologies such as AI and optical character recognition (OCR) in combination with market specific business rules. For online data, that means enabling instant and secured access to online platforms (such as telecoms).

On the financial service side, we ensure that beyond accessing information, we accelerate the decision making process for the internal teams. For this, we provide access to our ONE TEAM – Middle Office tool which automates or speeds up the time it takes to accept a customer’s application.

By leveraging cutting-edge technology and an expert data, we eliminate human error, speed up verification and significantly augment conversion rates. This approach aims to create a seamless user experience while deeply reinforcing the efficiency of Middle Office teams.

eKYC is a revolutionary approach to handling customer information. It combines over a decade of pragmatic financial service document management with a visionary data hub and efficiency-machine Middle Office.

Its strengths lie in the ability to:

1. Rapidly extract relevant information from documents with the leading AI

2. Seamlessly integrate data options for zero errors

3. Reduce human error by providing the most efficient sorting machine on the market

4. Drastically accelerate Middle Office validations

In short, it optimizes processes, increases efficiency and informs decisions through fast, accurate data analysis.

A service dedicated to efficient customer information validation.

It’s is always a challenge to harmonize terms. At QuickSign, we have used the following logic:

Some financial services include both identity and information under the same generic “KYC” term. We have chosen to seperate them in order to clarify our offer. At QuickSign, it’s easy to combine services. Feel free to reach out to see which workflow would make the most sense for your business case.

The short answer is yes. And if you don’t have OCRs – we have you covered.

Our experience in production is that OCRs are a small part of handling customer information efficiently. Their role is necessary to retrieve information automatically however, if used alone or without the proper business rules, they bring no added value to a workflow.

At QuickSign, we define added value by 1/ increased conversion rates and 2/ decreased time spent by agents to validate incoming onboarding files.

QuickSign secret sauce: we use the highest standard OCRs available on the market and combine them with financial service specific business rules, data hubs and our Middle Office. Contact us for more information on how eKYC will add value to your existing workflows production.

Of course. At QuickSign, we know that ROI is key for financial services looking to automate or accelerate their digital processes. Business analysts and decision makers need to have facts in order to prove performance in production and return on investment.

eKYC is built to handle customer information efficiently. To ensure optimized performance and to continously improve workflows in production, QuickSign (as part of its ONE TEAM EXPERIENCE) provides access to real time performance dashboards.

As an option, our Data Performance Experts can also provide in-depth workshops. Contact us for more information.

At QuickSign, we cover information that is necessary to complete an application to a financial product.

In continental Europe, these documents typically include: proof of address (electricity, gas, telecoms), IBAN, salary slip, driving license, claims list…

We handle both structured and non-structured documents.

Contact us to find out how we can help cover your needs.

Yes. Our eKYC service aims to obtain information on prospects, whatever the source. We therefore get information where it is: be it on documents, or directly on online platforms.

As an alternative to sending documents, we offer policyholders the option of instantly retrieving their supporting documents from the platform they use.

Yes, absolutely. The eKYC service was built exclusively for financial services who navigate strict compliance requirements. Our business rules are designed to adapt to each financial service to ensure the highest performance in production.

Working with QuickSign means working with financial service experts. Business rules are the key to automating or accelerating validation processes, whilst respecting compliance requirements.

In this context, eKYC provides standard, moderate or strict business rules depending on the marketing to compliance ratio requested by a financial service.

Once in production, our Data Performance Experts are available to deep dive into business rule optimization – that fit your exact needs.

Contact us for more information.

Check out our resources