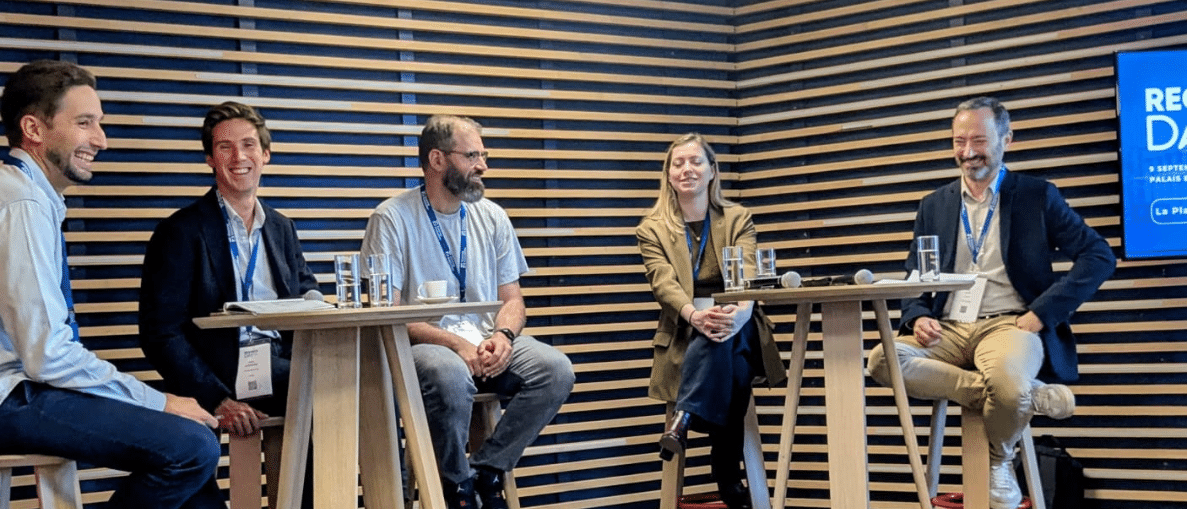

On September 9, Quicksign took part in RegTechDay 2025, organized by Finance Innovation at the Palais Brongniart in Paris. A must-attend event for finance and technology leaders, the conference brought together compliance, innovation, and digital experts. The key focus: how to reconcile growth ambitions with the regulatory inflation reshaping the industry.Alongside major market players, our CISO, Ahmed Boussadia, shared his perspective during a roundtable dedicated to neo-banks. Here’s what stood out from this insightful day: regulation is no longer a barrier, but a driver of trust and competitiveness.

A flagship event for the RegTech ecosystem

RegTechDay has become one of the leading gatherings for those shaping the future of regulatory technology in financial services. This year’s edition took place at the iconic Palais Brongniart, a historic symbol of Parisian finance.

The program featured conferences, debates, and roundtables covering today’s hottest topics: consumer protection, cybersecurity, digital identity, and major regulatory frameworks such as DORA, MiCA, the AI Act, and eIDAS 2.0 5 (European Comission). All of these are reshaping the rules of the game for banks, fintechs, and technology providers.

For Quicksign, Europe’s leader in digital onboarding, attending was essential—not only to listen and exchange with the ecosystem, but also to bring our hands-on experience to the table: how to strike the right balance between innovation, growth, and compliance.

We had the opportunity to join a roundtable moderated by Charles Plessis (B-Part Consulting), with:

- Ahmed Boussadia, Chief Information Security Officer, Quicksign

- Carole Danancher, General Manager France, Vivid Money

- Vasco Alexandre, Co-founder & CEO, Dotfile

- Nicolas Moreau, Chief Transformation Officer, Nickel

The theme? “How are neo-banks balancing growth, innovation, and regulatory requirements in 2025?”

Key takeaway: Regulation as a growth driver

Historically: regulation as a growth inhibitor

The discussion first reminded us why regulation was long seen as a burden. Fintechs and neo-banks often struggled with frameworks unfit for digital practices: delayed implementation, administrative complexity, and a lack of European harmonization.

Take lending as an example: KYC checks, while essential to fight fraud, can slash conversion rates by 40 to 75%. In other words, more than half of potential customers drop out due to heavy verification processes. Add to this the growing stack of directives—from DORA on cybersecurity to eIDAS 2.0 on digital identity—and compliance costs quickly weigh down fintechs’ growth momentum.

Today: a shift in mindset

The good news? Things are changing. As Ahmed Boussadia highlighted, compliance is no longer a final step, but part of product design from day one.

- This is “Compliance by Design”: integrating regulatory requirements early to reduce friction and even turn them into a competitive advantage.

- At Quicksign, our Product and Tech teams work closely with our CISO to embed each new regulatory framework into innovation that benefits the end-user.

- Customer experience and compliance are no longer in opposition—they can reinforce each other.

- Emerging technologies like artificial intelligence now help streamline compliance in real-time, reduce human error, and shorten delays.

“Growth and regulation are not incompatible: regulation also provides a reassuring framework for the end user.”

— Ahmed Boussadia

Tomorrow: towards a truly pan-European market?

Looking ahead, the panel ended on a note both optimistic and pragmatic. Yes, regulation is evolving in the right direction—especially with eIDAS 2.0 paving the way for a European digital identity wallet. This could finally enable truly pan-European financial services.

But challenges remain. Chief among them: national fragmentation. Each country still interprets EU directives differently. For example, Germany requires an additional micro-transfer for AML compliance, while France demands a specific PVID process. Instead of a single market, we get a patchwork of national practices.The paradox is clear: what has long been seen as a constraint—regulation—could become the very catalyst for Open Finance and market harmonization, provided these discrepancies are overcome.

From constraint to opportunity

RegTechDay 2025 made one thing clear: we are entering a new era. Regulation is no longer a necessary evil, but an opportunity—an opportunity to strengthen trust, improve customer experience, and build more resilient financial services.

For neo-banks, fintechs, and the wider financial ecosystem, the challenge is clear: keep innovating while embedding compliance intelligently. With Open Finance on the horizon and the European digital identity wallet in the works, regulation may well become one of the strongest engines of innovation.

👉 Interested in this topic? Get in touch !